Data Shows There Is a Lack of Correlation Between Crypto Prices

- Santiment tweeted yesterday that prices in the crypto market are currently not correlated.

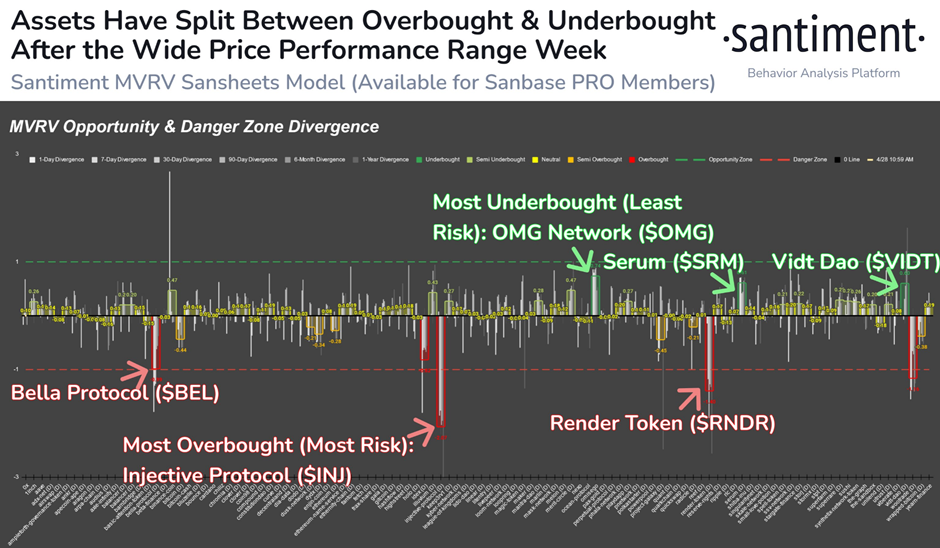

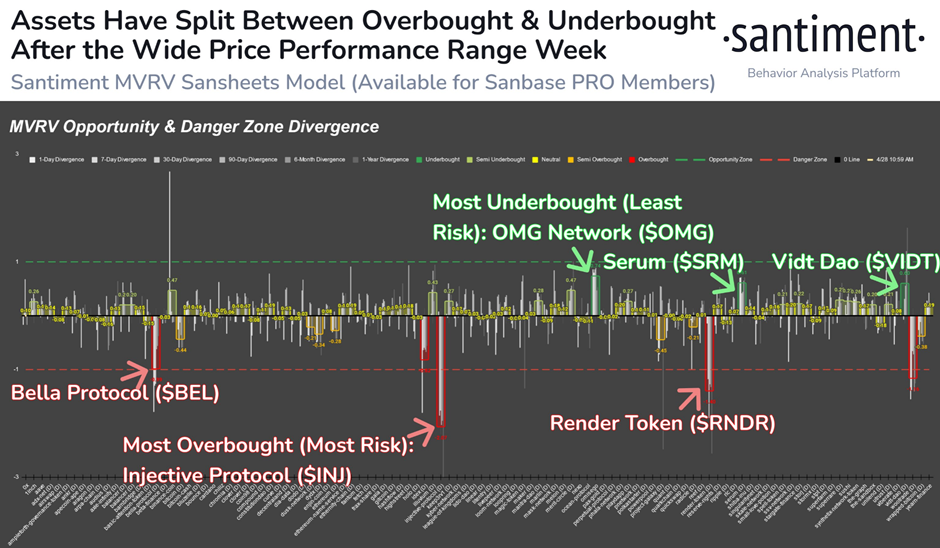

- According to the tweet, Santiment’s MVRV model shows that OMG, SRM and VIDT are good buys.

- Meanwhile, the MVRV model shows that BEL, INF and RNDR are currently risky investments.

Santiment, the blockchain intelligence firm, tweeted yesterday that prices in the crypto market have been more scattered and non-correlated this April than in previous months. In the tweet, Santiment added that their MVRV model suggests that it is a good time to buy OMG Network (OMG), Serum (SRM) and VIDT DAO (VIDT).

Meanwhile, the model shows that Bella Protocol (BEL), Injective (INJ) and Render Token (RNDR) are risky investments presently. The model also shows that assets in the crypto market have split between overbought and underbought after the varying price performances over the past 7 days.

Currently, the global crypto market cap is down 0.28% over the last 24 hours according to CoinMarketCap. As a result, the total crypto market cap is estimated to be $1.21 trillion at press time.

Despite the global market cap dropping in the past day, …

The post Data Shows There Is a Lack of Correlation Between Crypto Prices appeared first on Coin Edition.

Read More

Record $21.82B Flows into US Ethereum ETFs

Data Shows There Is a Lack of Correlation Between Crypto Prices

- Santiment tweeted yesterday that prices in the crypto market are currently not correlated.

- According to the tweet, Santiment’s MVRV model shows that OMG, SRM and VIDT are good buys.

- Meanwhile, the MVRV model shows that BEL, INF and RNDR are currently risky investments.

Santiment, the blockchain intelligence firm, tweeted yesterday that prices in the crypto market have been more scattered and non-correlated this April than in previous months. In the tweet, Santiment added that their MVRV model suggests that it is a good time to buy OMG Network (OMG), Serum (SRM) and VIDT DAO (VIDT).

Meanwhile, the model shows that Bella Protocol (BEL), Injective (INJ) and Render Token (RNDR) are risky investments presently. The model also shows that assets in the crypto market have split between overbought and underbought after the varying price performances over the past 7 days.

Currently, the global crypto market cap is down 0.28% over the last 24 hours according to CoinMarketCap. As a result, the total crypto market cap is estimated to be $1.21 trillion at press time.

Despite the global market cap dropping in the past day, …

The post Data Shows There Is a Lack of Correlation Between Crypto Prices appeared first on Coin Edition.

Read More