Adani’s Cement Empire Expansion: Will The AMBUJACEM Stock Price Reach New Peaks by 2025?

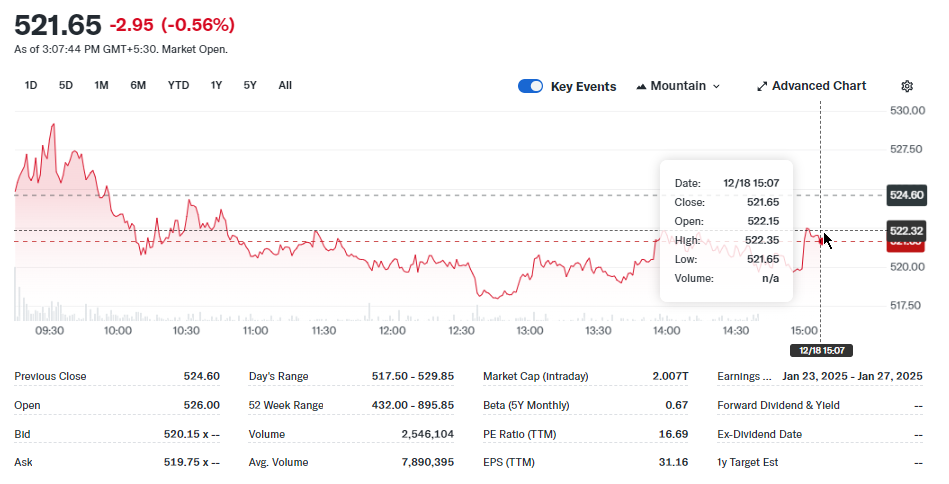

The Adani cement merger is changing India’s cement industry. The company will join Sanghi Industries and Penna Cement with Ambuja Cements Ltd. This big change will affect the cement industry in India in 2025. Many investors are now studying Ambuja Cements’ stock analysis. They also watch Adani Power’s Limited Stock movements with interest.

Also Read: Fed’s 3rd Rate Cut Due Today: What a 0.25% Drop Means for Crypto Markets

How the Adani Cement Merger Could Impact AMBUJACEM Stock Price by 2025

Merger Structure and Immediate Market Response

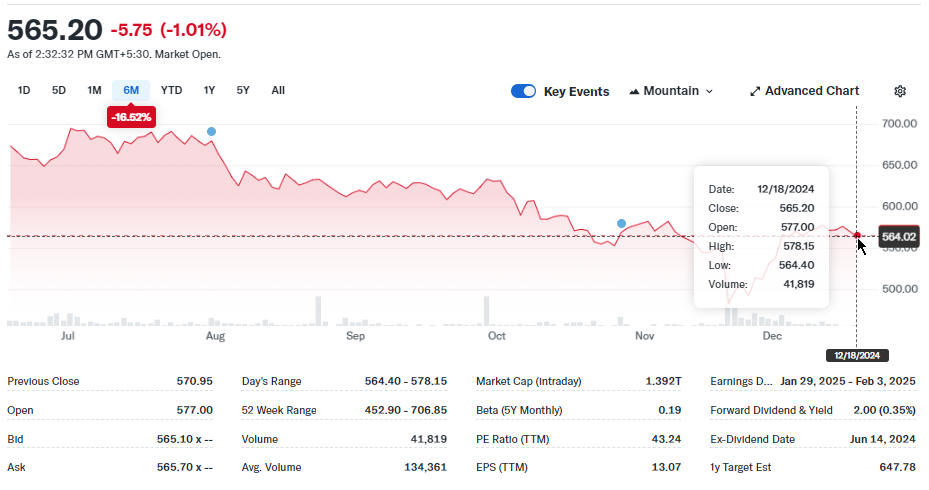

Under the Adani cement merger, “Ambuja will give 12 shares for every 100 of Sanghi Industries to shareholders.” The company also “will pay 321.50 rupees each to acquire Penna Cement shares it doesn’t hold now.” Ambuja’s shares went up by 1.4% in Mumbai trading at first. The price went down later.

Strategic Market Positioning

The Adani cement merger follows their purchase of Holcim Ltd.’s Indian business in 2022. This made them “the country’s second-largest producer of the construction material.” Now, they compete better with UltraTech Cement Ltd. and its leader, Kumar Mangalam Birla. The Adani cement merger impacts India’s 2025 market growth significantly.

Also Read: $200K Bitcoin (BTC) in Sight by 2025, Predicts Bitfinex

Financial Performance and Stock Outlook

Current Ambuja Cements stock analysis shows mixed results. Sanghi’s shares dropped about 13%, “touching the lowest level since June last year.”

This also applies to the Adani Power Limited stock news, which makes investors think carefully about long-term results. The merger needs one year to finish after getting approvals. Adani cement merger dynamics are therefore being scrutinized.

Future Growth Prospects

The Adani stock prediction looks at several different things. These include cost savings and market growth, among other topics. The company wants to grow bigger by joining these businesses; thus, India’s cement industry in 2025 looks strong. India’s building projects help this growth and the Adani cement merger is well-positioned to capitalize on this.

Also Read: Ripple (XRP) vs. SEC: Gensler Gone, Crenshaw Out, Final Verdict Jan 15

Read More

UPS Offering Buyouts: UBS Cuts Price Target to $135 on Slowing Demand

Adani’s Cement Empire Expansion: Will The AMBUJACEM Stock Price Reach New Peaks by 2025?

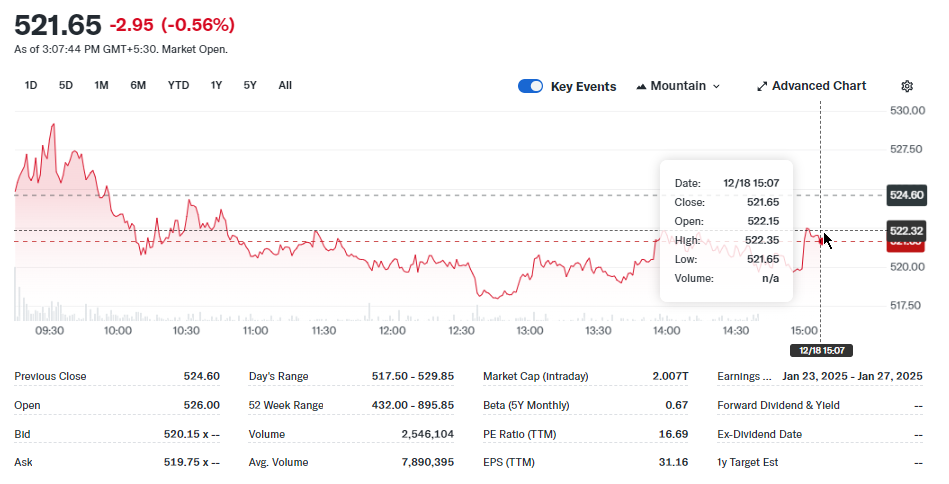

The Adani cement merger is changing India’s cement industry. The company will join Sanghi Industries and Penna Cement with Ambuja Cements Ltd. This big change will affect the cement industry in India in 2025. Many investors are now studying Ambuja Cements’ stock analysis. They also watch Adani Power’s Limited Stock movements with interest.

Also Read: Fed’s 3rd Rate Cut Due Today: What a 0.25% Drop Means for Crypto Markets

How the Adani Cement Merger Could Impact AMBUJACEM Stock Price by 2025

Merger Structure and Immediate Market Response

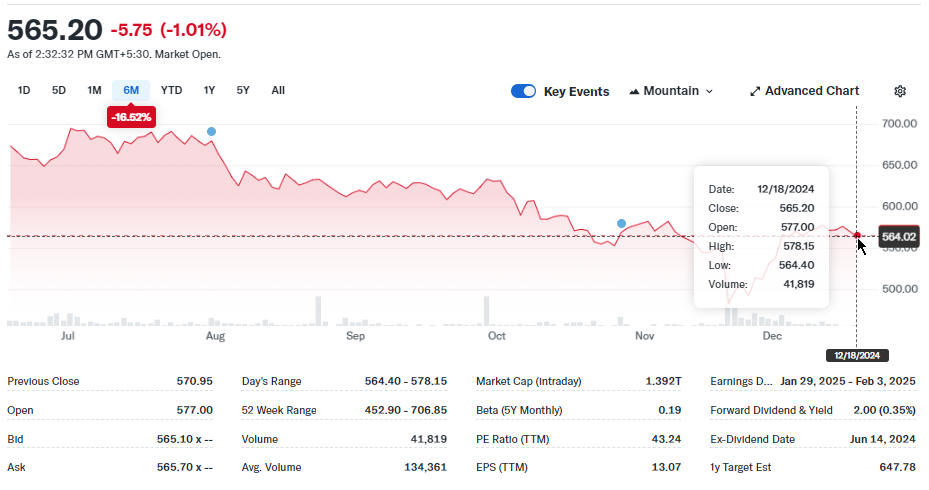

Under the Adani cement merger, “Ambuja will give 12 shares for every 100 of Sanghi Industries to shareholders.” The company also “will pay 321.50 rupees each to acquire Penna Cement shares it doesn’t hold now.” Ambuja’s shares went up by 1.4% in Mumbai trading at first. The price went down later.

Strategic Market Positioning

The Adani cement merger follows their purchase of Holcim Ltd.’s Indian business in 2022. This made them “the country’s second-largest producer of the construction material.” Now, they compete better with UltraTech Cement Ltd. and its leader, Kumar Mangalam Birla. The Adani cement merger impacts India’s 2025 market growth significantly.

Also Read: $200K Bitcoin (BTC) in Sight by 2025, Predicts Bitfinex

Financial Performance and Stock Outlook

Current Ambuja Cements stock analysis shows mixed results. Sanghi’s shares dropped about 13%, “touching the lowest level since June last year.”

This also applies to the Adani Power Limited stock news, which makes investors think carefully about long-term results. The merger needs one year to finish after getting approvals. Adani cement merger dynamics are therefore being scrutinized.

Future Growth Prospects

The Adani stock prediction looks at several different things. These include cost savings and market growth, among other topics. The company wants to grow bigger by joining these businesses; thus, India’s cement industry in 2025 looks strong. India’s building projects help this growth and the Adani cement merger is well-positioned to capitalize on this.

Also Read: Ripple (XRP) vs. SEC: Gensler Gone, Crenshaw Out, Final Verdict Jan 15

Read More