Ethereum Heats Up as Bitcoin Cools — Is a $4K Breakout Coming?

- ETH open interest just hit $58B, with volume jumping and BTC futures cooling.

- Low funding rate = organic buying, not hype-driven leverage.

- $4K is the key resistance — breakout = fireworks, rejection = pullback to $3,750.

While Bitcoin takes a breather, Ethereum’s suddenly become the hot topic. Capital is flowing fast — really fast — and the charts are lighting up across the board. With over $58 billion in futures bets now riding on ETH, traders seem to be setting the stage for something big. Maybe really big.

So what’s actually happening here? Let’s cut through the noise and look at the signals that matter.

Traders Ditch BTC Futures for ETH — The Rotation Is Real

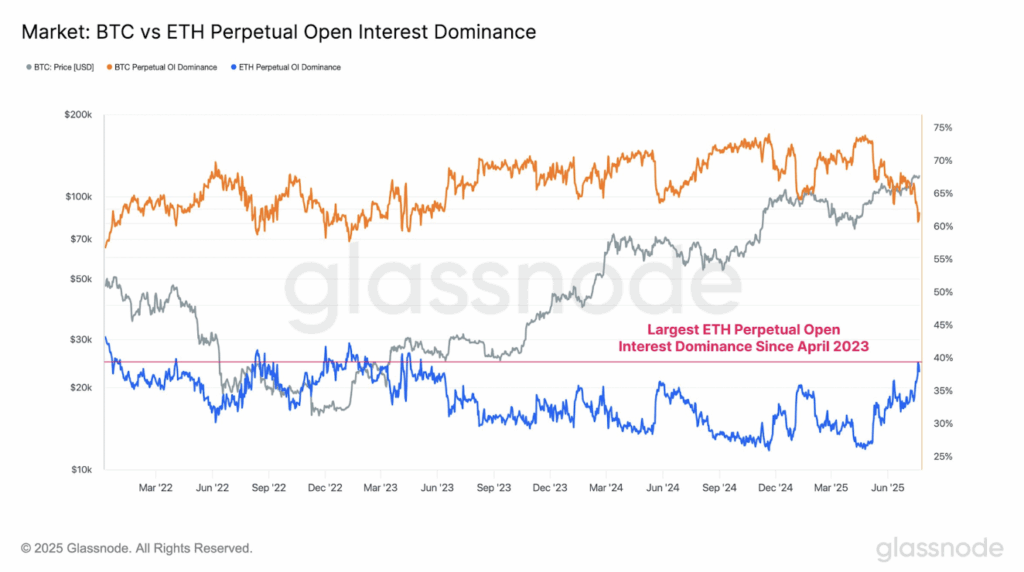

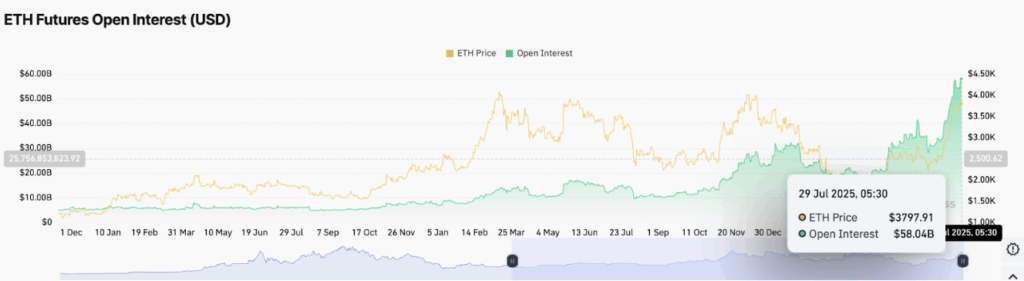

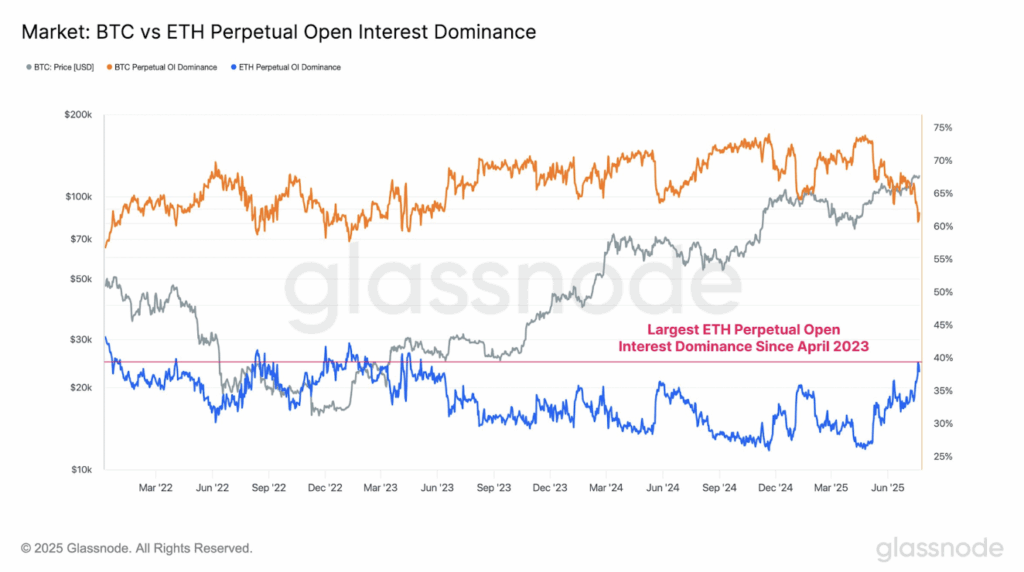

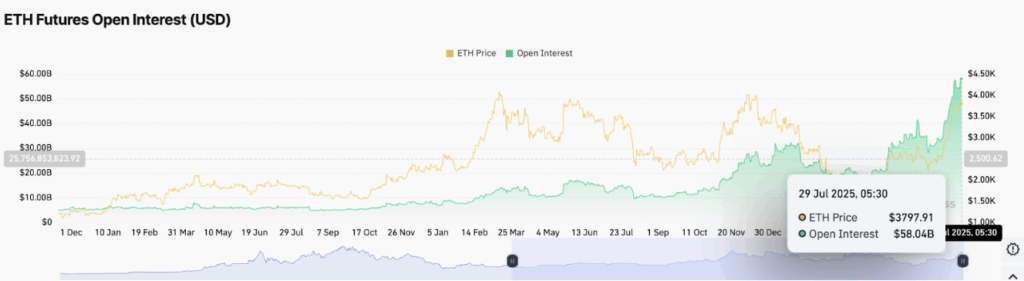

One key chart from Glassnode shows Ethereum’s open interest (aka futures bets still in play) just shot past $58 billion — the highest all year. And there’s more: ETH’s share of total crypto futures is now just shy of 40%. Bitcoin’s, meanwhile, has dipped to about 53%.

Just weeks ago, BTC held 60% dominance. Now, Ethereum’s catching up fast. That’s not some fluke — it’s a clear sign that traders believe ETH might deliver better short-term returns.

And yeah, the last time we saw this kind of setup? Ethereum ran all the way to $4,000.

Plus, perpetual futures volume for ETH jumped 25% over the week, while Bitcoin’s dropped nearly 5%. That’s rotation in action — big money shifting gears.

ETH Rally Looks Real — No Leverage Blowout Yet

Even with all this hype, Ethereum’s funding rate is still chilling at a low 0.0091%. What’s that mean? Basically, people aren’t overleveraged — yet.

Usually, when too many traders go long with borrowed funds, the funding rate spikes and a pullback smacks them in the face. But right now? This looks like healthy spot buying, not degens maxing out leverage. That’s a good thing.

Liquidation Map: Bulls in Control… for Now

The liquidation map from Bitget shows ETH longs are stacked. We’re talking $6.79 billion in bullish bets versus just $2.77 billion in shorts — that’s a 2.45x ratio. Bulls are running the show, no doubt.

But there’s a catch. If ETH drops too fast, those long positions could start getting liquidated, triggering a cascade. It’s a classic “top-heavy” setup — strong, but a little shaky if price dips too quick.

So yeah, bulls are flexing, but they better hope ETH holds key levels or it could get messy real fast.

ETH Isn’t Following BTC Anymore — It’s Leading

Here’s something interesting: ETH/BTC is on the rise. For once, Ethereum isn’t just following Bitcoin’s lead — it’s moving on its own. That shift is catching attention from traders who want momentum, not just a tag-along play.

If ETH keeps outpacing BTC while the latter chops sideways, don’t be surprised to see more capital rotate into Ethereum — especially from folks chasing the next breakout.

Eyes on $4,000 — The Make-or-Break Level

Ethereum is now hovering just below the $3,900–$4,000 resistance zone. It’s a heavy one. If bulls can push through $3,913 with some solid volume, we could see a sprint to $4,200 or even $4,300.

But if it fails again? Don’t be shocked if it snaps back to $3,750 — a key support area.

Bottom line: ETH is building serious momentum, and traders are clearly rotating away from BTC. But with a crowded long setup and a major ceiling overhead, this next move could be critical.

The post Ethereum Heats Up as Bitcoin Cools — Is a $4K Breakout Coming? first appeared on BlockNews.

Ethereum Heats Up as Bitcoin Cools — Is a $4K Breakout Coming?

- ETH open interest just hit $58B, with volume jumping and BTC futures cooling.

- Low funding rate = organic buying, not hype-driven leverage.

- $4K is the key resistance — breakout = fireworks, rejection = pullback to $3,750.

While Bitcoin takes a breather, Ethereum’s suddenly become the hot topic. Capital is flowing fast — really fast — and the charts are lighting up across the board. With over $58 billion in futures bets now riding on ETH, traders seem to be setting the stage for something big. Maybe really big.

So what’s actually happening here? Let’s cut through the noise and look at the signals that matter.

Traders Ditch BTC Futures for ETH — The Rotation Is Real

One key chart from Glassnode shows Ethereum’s open interest (aka futures bets still in play) just shot past $58 billion — the highest all year. And there’s more: ETH’s share of total crypto futures is now just shy of 40%. Bitcoin’s, meanwhile, has dipped to about 53%.

Just weeks ago, BTC held 60% dominance. Now, Ethereum’s catching up fast. That’s not some fluke — it’s a clear sign that traders believe ETH might deliver better short-term returns.

And yeah, the last time we saw this kind of setup? Ethereum ran all the way to $4,000.

Plus, perpetual futures volume for ETH jumped 25% over the week, while Bitcoin’s dropped nearly 5%. That’s rotation in action — big money shifting gears.

ETH Rally Looks Real — No Leverage Blowout Yet

Even with all this hype, Ethereum’s funding rate is still chilling at a low 0.0091%. What’s that mean? Basically, people aren’t overleveraged — yet.

Usually, when too many traders go long with borrowed funds, the funding rate spikes and a pullback smacks them in the face. But right now? This looks like healthy spot buying, not degens maxing out leverage. That’s a good thing.

Liquidation Map: Bulls in Control… for Now

The liquidation map from Bitget shows ETH longs are stacked. We’re talking $6.79 billion in bullish bets versus just $2.77 billion in shorts — that’s a 2.45x ratio. Bulls are running the show, no doubt.

But there’s a catch. If ETH drops too fast, those long positions could start getting liquidated, triggering a cascade. It’s a classic “top-heavy” setup — strong, but a little shaky if price dips too quick.

So yeah, bulls are flexing, but they better hope ETH holds key levels or it could get messy real fast.

ETH Isn’t Following BTC Anymore — It’s Leading

Here’s something interesting: ETH/BTC is on the rise. For once, Ethereum isn’t just following Bitcoin’s lead — it’s moving on its own. That shift is catching attention from traders who want momentum, not just a tag-along play.

If ETH keeps outpacing BTC while the latter chops sideways, don’t be surprised to see more capital rotate into Ethereum — especially from folks chasing the next breakout.

Eyes on $4,000 — The Make-or-Break Level

Ethereum is now hovering just below the $3,900–$4,000 resistance zone. It’s a heavy one. If bulls can push through $3,913 with some solid volume, we could see a sprint to $4,200 or even $4,300.

But if it fails again? Don’t be shocked if it snaps back to $3,750 — a key support area.

Bottom line: ETH is building serious momentum, and traders are clearly rotating away from BTC. But with a crowded long setup and a major ceiling overhead, this next move could be critical.

The post Ethereum Heats Up as Bitcoin Cools — Is a $4K Breakout Coming? first appeared on BlockNews.