Cardano’s Tug-of-War: Whales Selling, Retail Holding, Shorts Circling

- ADA dropped 7.6% in 24 hours, but it’s still up nearly 29% on the month.

- Whales are selling, retail is buying, and shorts are building—creating a three-way battle.

- Break below $0.68 = trouble. Break above $0.78 = short squeeze potential.

Cardano’s had better days. After running up almost 30% in the past month, it just gave back a big chunk—down 7.6% in the last 24 hours. So now, traders are sitting in that weird in-between space: a mix of hope and uh-oh, not again.

Behind the price drop, there’s a deeper battle going on. The biggest whales are quietly trimming their bags. Retail folks? Still HODLing. Meanwhile, short-sellers in derivatives markets are starting to smell blood. With all this push and pull, one spark could be all it takes to tip the scales.

Whales Back Off While Network Activity Cools

According to on-chain data, Cardano’s “super whales”—those holding over a billion ADA—have reduced their holdings from 5.43% to 5.02% since late June. Sounds small, but in whale territory, even a 0.4% shift is a pretty big deal.

On top of that, activity on the network is down. Way down. Active addresses have fallen more than 40% since mid-July, dropping from 42,000 to under 25,000. That slowdown started right after ADA hit $0.92, which now looks like a local top. Could be why the whales are cooling off too—they’re watching the same numbers we are.

Retail Isn’t Flinching—But Derivatives Traders Bet Against Them

Even as whales back off, retail traders aren’t letting go. In fact, they’ve been pulling ADA off exchanges for months, a sign they’re more interested in stacking than selling. That’s usually bullish—it shows conviction.

But not everyone’s buying the dip. Over on Bitget, short sellers are stacking up. There’s $141.7 million in short positions right now compared to just $74 million in longs. That’s nearly double. It paints a clear picture: leveraged traders are expecting more pain.

So now we’ve got a three-sided fight: whales trimming, retailers holding, and shorts betting on a breakdown. That mix doesn’t last forever. Someone’s gonna blink.

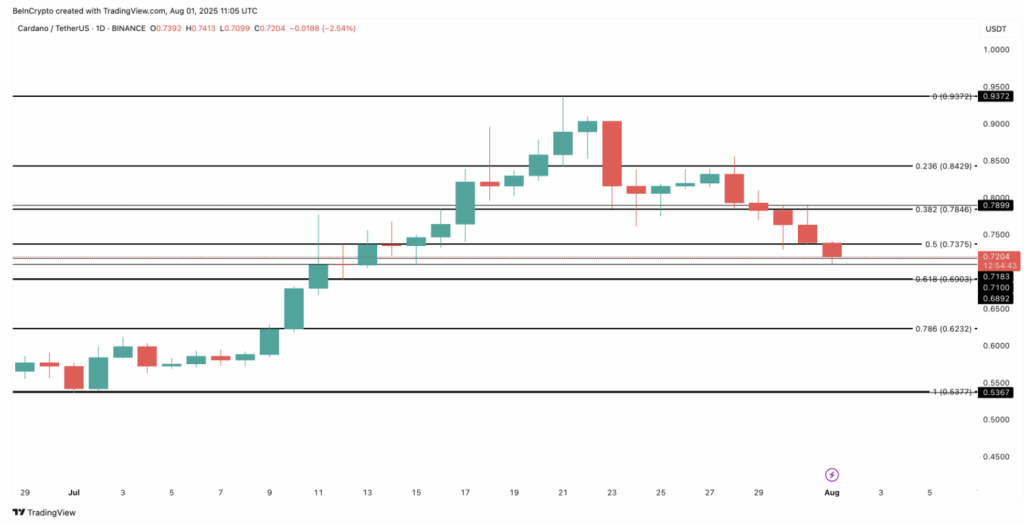

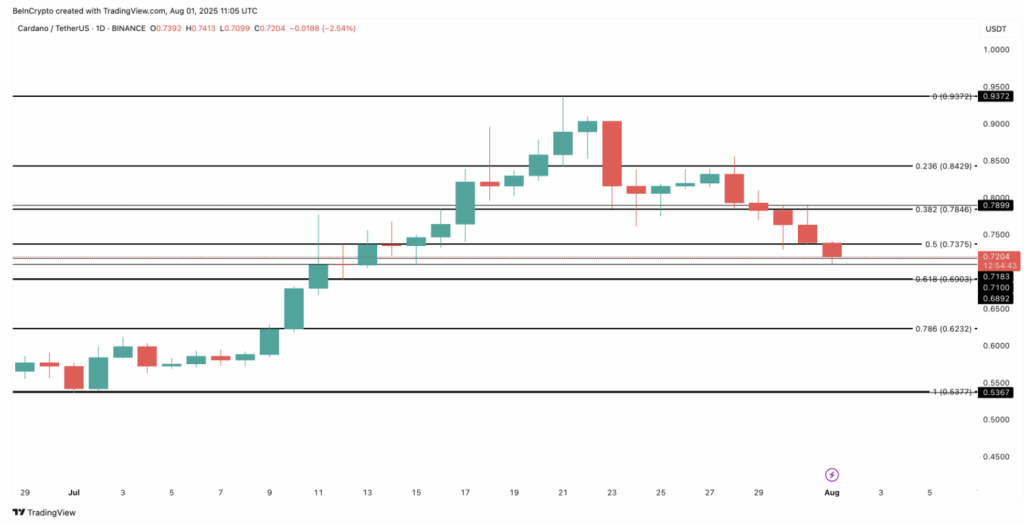

Key Price Levels Could Decide the Fight

ADA’s sitting near some make-or-break levels right now. Support at $0.71 and $0.68 is holding—for now. But if price breaks below, we could be looking at a drop to $0.62. And that would probably trigger another wave of liquidations, wiping out a chunk of the remaining longs.

On the flip side, if bulls manage to push it back above $0.73 or even $0.78, things could flip fast. That would put the pressure on the shorts instead, especially if it sparks a mini short squeeze. From there, the path toward $0.84 or even $0.93 isn’t that far-fetched.

Who’s Gonna Win This One?

At the moment, it’s a stand-off. Whales are offloading, smallholders are holding firm, and leveraged shorts are circling like sharks. The next big move might come down to just one thing: whether this pile of shorts gets squeezed—or keeps dragging the price down.

The post Cardano’s Tug-of-War: Whales Selling, Retail Holding, Shorts Circling first appeared on BlockNews.

Read More

HyperLiquid Slips Below Key Resistance — Is $30 the Next Stop?

Cardano’s Tug-of-War: Whales Selling, Retail Holding, Shorts Circling

- ADA dropped 7.6% in 24 hours, but it’s still up nearly 29% on the month.

- Whales are selling, retail is buying, and shorts are building—creating a three-way battle.

- Break below $0.68 = trouble. Break above $0.78 = short squeeze potential.

Cardano’s had better days. After running up almost 30% in the past month, it just gave back a big chunk—down 7.6% in the last 24 hours. So now, traders are sitting in that weird in-between space: a mix of hope and uh-oh, not again.

Behind the price drop, there’s a deeper battle going on. The biggest whales are quietly trimming their bags. Retail folks? Still HODLing. Meanwhile, short-sellers in derivatives markets are starting to smell blood. With all this push and pull, one spark could be all it takes to tip the scales.

Whales Back Off While Network Activity Cools

According to on-chain data, Cardano’s “super whales”—those holding over a billion ADA—have reduced their holdings from 5.43% to 5.02% since late June. Sounds small, but in whale territory, even a 0.4% shift is a pretty big deal.

On top of that, activity on the network is down. Way down. Active addresses have fallen more than 40% since mid-July, dropping from 42,000 to under 25,000. That slowdown started right after ADA hit $0.92, which now looks like a local top. Could be why the whales are cooling off too—they’re watching the same numbers we are.

Retail Isn’t Flinching—But Derivatives Traders Bet Against Them

Even as whales back off, retail traders aren’t letting go. In fact, they’ve been pulling ADA off exchanges for months, a sign they’re more interested in stacking than selling. That’s usually bullish—it shows conviction.

But not everyone’s buying the dip. Over on Bitget, short sellers are stacking up. There’s $141.7 million in short positions right now compared to just $74 million in longs. That’s nearly double. It paints a clear picture: leveraged traders are expecting more pain.

So now we’ve got a three-sided fight: whales trimming, retailers holding, and shorts betting on a breakdown. That mix doesn’t last forever. Someone’s gonna blink.

Key Price Levels Could Decide the Fight

ADA’s sitting near some make-or-break levels right now. Support at $0.71 and $0.68 is holding—for now. But if price breaks below, we could be looking at a drop to $0.62. And that would probably trigger another wave of liquidations, wiping out a chunk of the remaining longs.

On the flip side, if bulls manage to push it back above $0.73 or even $0.78, things could flip fast. That would put the pressure on the shorts instead, especially if it sparks a mini short squeeze. From there, the path toward $0.84 or even $0.93 isn’t that far-fetched.

Who’s Gonna Win This One?

At the moment, it’s a stand-off. Whales are offloading, smallholders are holding firm, and leveraged shorts are circling like sharks. The next big move might come down to just one thing: whether this pile of shorts gets squeezed—or keeps dragging the price down.

The post Cardano’s Tug-of-War: Whales Selling, Retail Holding, Shorts Circling first appeared on BlockNews.

Read More