BlackRock Now Holding 403,725 Bitcoin (BTC) Worth $26,980,000,000 After Accumulation Spree

BlackRock, the largest asset manager in the world, is now holding tens of billions of dollars worth of Bitcoin (BTC), the firm’s data shows.

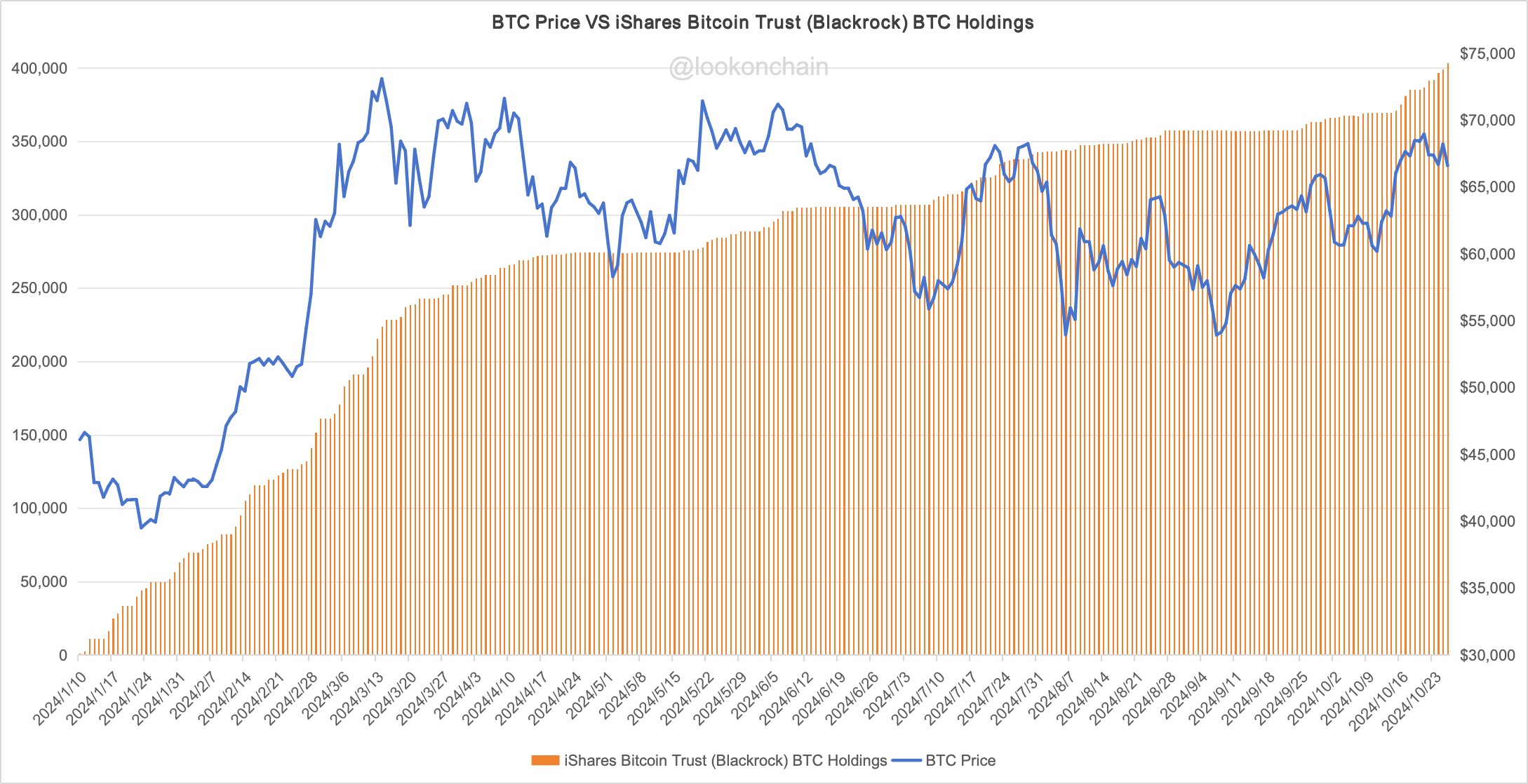

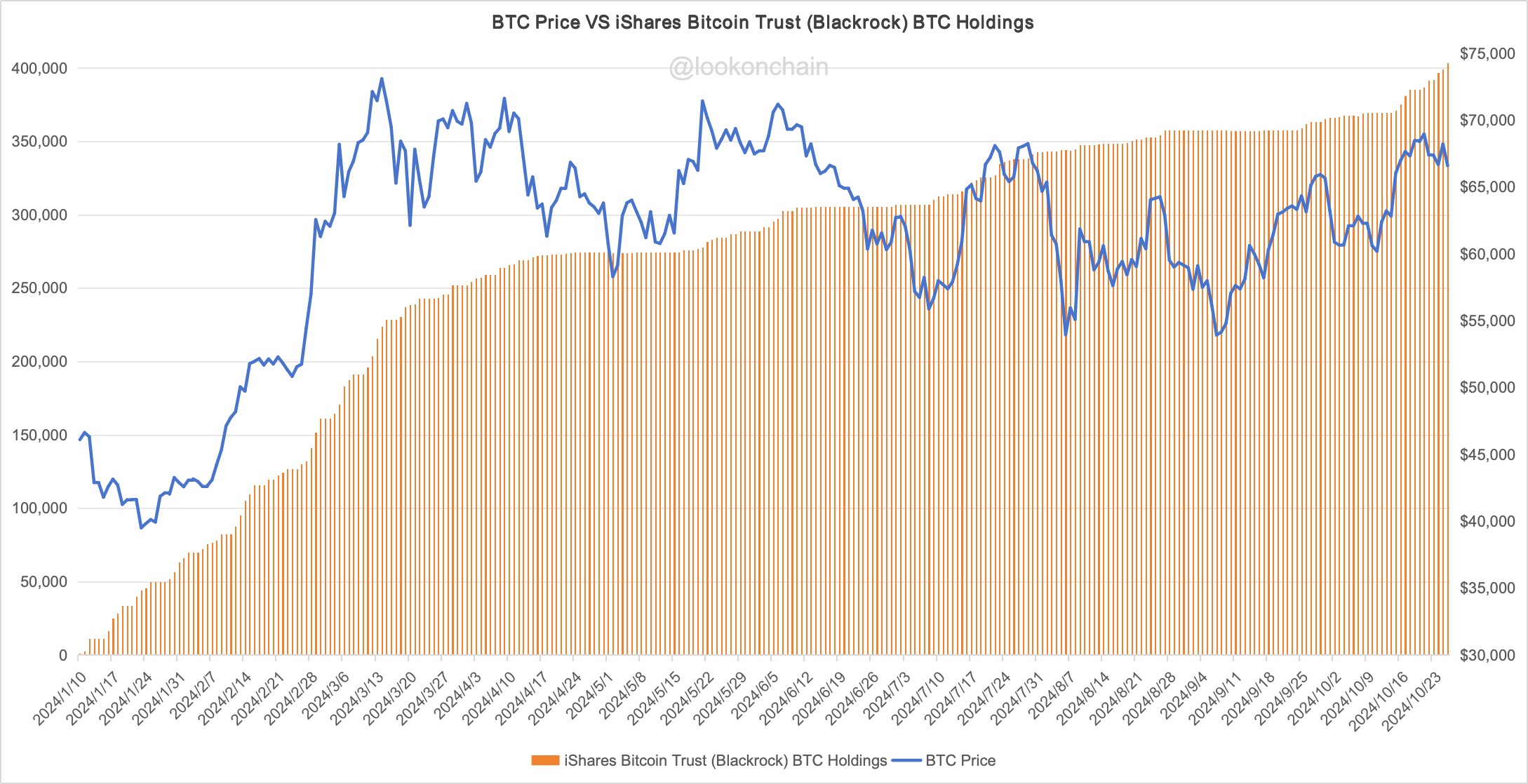

According to the asset management’s disclosures, BlackRock holds 403,725 BTC worth $26.98 billion in its iShares Bitcoin Trust exchange-traded fund (ETF).

Blockchain tracking firm Lookonchain says that in the last two weeks alone, BlackRock has gobbled up 34,085 BTC worth $2.3 billion.

The iShares Bitcoin Trust ETF (IBIT) went live on January 5th of this year and has since delivered 44.80% returns as of September 30th.

In a recent report, BlackRock, a firm with over $10 trillion in assets under management, said that Bitcoin could act as a hedge against the United States’ mounting debt and other macroeconomic concerns.

“While Bitcoin has shown instances of short-term co-movements with equities and other ‘risk assets,’ over the longer term its fundamental drivers are starkly different, and in many cases inverted versus most traditional investment assets.

As the global investment community grapples with rising geopolitical tensions, concerns over the state of US debt and deficits and increased political instability around the world, Bitcoin may be seen as an increasingly unique diversifier against some of these fiscal, monetary and geopolitical risk factors investors may face elsewhere in their portfolio.”

At time of writing, Bitcoin is trading at $67,735.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post BlackRock Now Holding 403,725 Bitcoin (BTC) Worth $26,980,000,000 After Accumulation Spree appeared first on The Daily Hodl.

BlackRock Now Holding 403,725 Bitcoin (BTC) Worth $26,980,000,000 After Accumulation Spree

BlackRock, the largest asset manager in the world, is now holding tens of billions of dollars worth of Bitcoin (BTC), the firm’s data shows.

According to the asset management’s disclosures, BlackRock holds 403,725 BTC worth $26.98 billion in its iShares Bitcoin Trust exchange-traded fund (ETF).

Blockchain tracking firm Lookonchain says that in the last two weeks alone, BlackRock has gobbled up 34,085 BTC worth $2.3 billion.

The iShares Bitcoin Trust ETF (IBIT) went live on January 5th of this year and has since delivered 44.80% returns as of September 30th.

In a recent report, BlackRock, a firm with over $10 trillion in assets under management, said that Bitcoin could act as a hedge against the United States’ mounting debt and other macroeconomic concerns.

“While Bitcoin has shown instances of short-term co-movements with equities and other ‘risk assets,’ over the longer term its fundamental drivers are starkly different, and in many cases inverted versus most traditional investment assets.

As the global investment community grapples with rising geopolitical tensions, concerns over the state of US debt and deficits and increased political instability around the world, Bitcoin may be seen as an increasingly unique diversifier against some of these fiscal, monetary and geopolitical risk factors investors may face elsewhere in their portfolio.”

At time of writing, Bitcoin is trading at $67,735.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

The post BlackRock Now Holding 403,725 Bitcoin (BTC) Worth $26,980,000,000 After Accumulation Spree appeared first on The Daily Hodl.