$3.6 Billion Bitcoin, Ethereum Options Expiry as “Big Beautiful Bill” Passes, What’s Next?

Just as US President Donald Trump is about to sign the “Big Beautiful Bill,” raising the debt ceiling by another $5 trillion, a massive $3.6 billion in Bitcoin BTC $108 962 24h volatility: 0.8% Market cap: $2.17 T Vol. 24h: $25.73 B and Ethereum ETH $2 551 24h volatility: 1.7% Market cap: $307.94 B Vol. 24h: $17.45 B options are expiring today, after a bullish week in the crypto market.

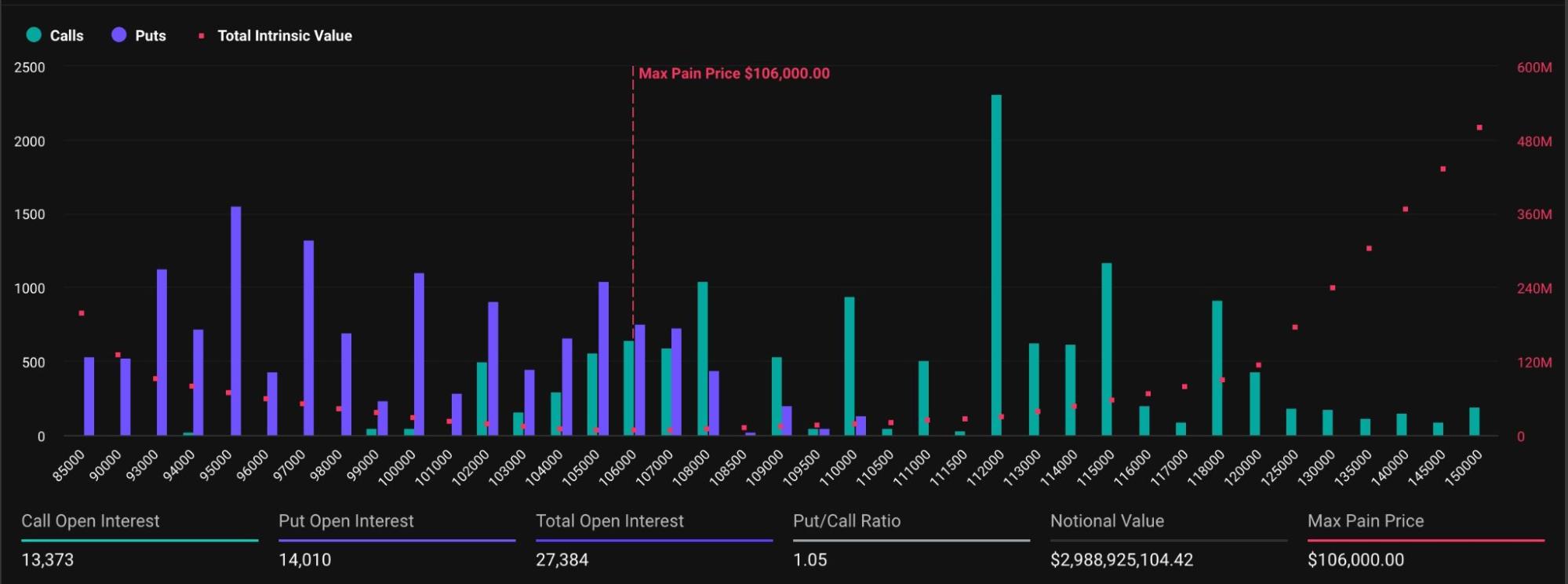

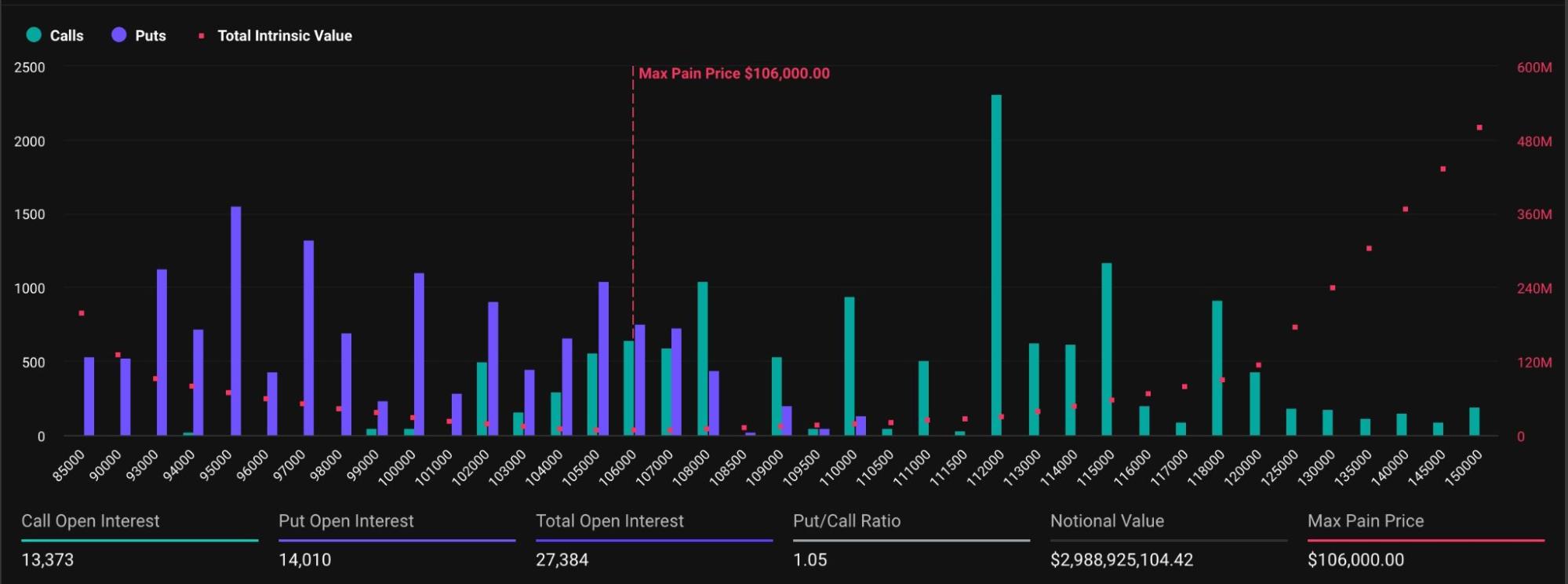

As per the data from the derivatives platform Deribit, a total of 27,384 Bitcoin options contracts will expire on July 4, with a notional value of $2.98 billion. This is a significant drop from last week’s expiry of 139,390 contracts. Furthermore, the put-call ratio is currently at 1.05 with a total of 14,010 put contracts and 13,373 call contracts.

Bitcoin Options Expiry | Source: Deribit

The put-call ratio above 1.0 highlights a bearish outlook, with more investors hedging against potential price declines than betting on upward movement.

On the other hand, a total of 237,278 Ethereum options contracts are about to expire with a notional value of $610 million. Moreover, 131,881 put contracts outweigh 105,397 call contracts, resulting in a put-to-call ratio of 1.25.

Ethereum Options Expiry | Source: Deribit

Both Bitcoin and Ethereum have registered gains over the past week, with bullish optimism on the rise.

https://t.co/n0OcjSGEsP Community Daily Digest

Published: 2025-07-03

Overall Market Sentiment

The group shows a mixed sentiment with tactical bearishness in the short term but maintains underlying bullish conviction, particularly around key resistance levels like 90k and 102k.…

— Greeks.live (@GreeksLive) July 3, 2025

Where’s bitcoin and ethereum price heading next?

Bitcoin seems to be flirting at $109,000 as bulls and bears find each other at a crossroads. According to crypto analyst Rekt Capital, Bitcoin (BTC) needs to hold above $108,890 through the end of the week to secure a bullish weekly close above its final major resistance level. A successful close above this threshold could set the stage for continued upward momentum.

Bitcoin just needs to stay above $108890 for the rest of the week to position itself for a bullish Weekly Close above the final major resistance (red)$BTC #Crypto #Bitcoin https://t.co/u1YrxcmU6t pic.twitter.com/GU873pDqIo

— Rekt Capital (@rektcapital) July 3, 2025

On the other hand, veteran market analyst Arthur Hayes expects a Bitcoin price crash to $90,000 ahead of the Jackson Hole event in August.

Similarly, Crypto analyst Rekt Capital noted a strong turnaround in Ethereum (ETH) price action, as the asset attempts to reclaim the recently lost ~$2,500 support level.

Quite the turnaround as Ethereum tries to actually position itself for a reclaim of the recently lost ~$2500 support

Upcoming Weekly Close will dictate whether ETH confirms positioning in its Range or attempts a retest of ~$2500 back into support#ETH #Crypto #Ethereum https://t.co/2ky7C6vocJ pic.twitter.com/jhxkfQHkvf

— Rekt Capital (@rektcapital) July 3, 2025

The upcoming weekly close will be critical in determining whether ETH successfully re-establishes itself within its prior trading range or merely retests the $2,500 mark without confirmation. Traders are closely watching for a decisive move that could signal the next directional shift.

The post $3.6 Billion Bitcoin, Ethereum Options Expiry as “Big Beautiful Bill” Passes, What’s Next? appeared first on Coinspeaker.

$3.6 Billion Bitcoin, Ethereum Options Expiry as “Big Beautiful Bill” Passes, What’s Next?

Just as US President Donald Trump is about to sign the “Big Beautiful Bill,” raising the debt ceiling by another $5 trillion, a massive $3.6 billion in Bitcoin BTC $108 962 24h volatility: 0.8% Market cap: $2.17 T Vol. 24h: $25.73 B and Ethereum ETH $2 551 24h volatility: 1.7% Market cap: $307.94 B Vol. 24h: $17.45 B options are expiring today, after a bullish week in the crypto market.

As per the data from the derivatives platform Deribit, a total of 27,384 Bitcoin options contracts will expire on July 4, with a notional value of $2.98 billion. This is a significant drop from last week’s expiry of 139,390 contracts. Furthermore, the put-call ratio is currently at 1.05 with a total of 14,010 put contracts and 13,373 call contracts.

Bitcoin Options Expiry | Source: Deribit

The put-call ratio above 1.0 highlights a bearish outlook, with more investors hedging against potential price declines than betting on upward movement.

On the other hand, a total of 237,278 Ethereum options contracts are about to expire with a notional value of $610 million. Moreover, 131,881 put contracts outweigh 105,397 call contracts, resulting in a put-to-call ratio of 1.25.

Ethereum Options Expiry | Source: Deribit

Both Bitcoin and Ethereum have registered gains over the past week, with bullish optimism on the rise.

https://t.co/n0OcjSGEsP Community Daily Digest

Published: 2025-07-03

Overall Market Sentiment

The group shows a mixed sentiment with tactical bearishness in the short term but maintains underlying bullish conviction, particularly around key resistance levels like 90k and 102k.…

— Greeks.live (@GreeksLive) July 3, 2025

Where’s bitcoin and ethereum price heading next?

Bitcoin seems to be flirting at $109,000 as bulls and bears find each other at a crossroads. According to crypto analyst Rekt Capital, Bitcoin (BTC) needs to hold above $108,890 through the end of the week to secure a bullish weekly close above its final major resistance level. A successful close above this threshold could set the stage for continued upward momentum.

Bitcoin just needs to stay above $108890 for the rest of the week to position itself for a bullish Weekly Close above the final major resistance (red)$BTC #Crypto #Bitcoin https://t.co/u1YrxcmU6t pic.twitter.com/GU873pDqIo

— Rekt Capital (@rektcapital) July 3, 2025

On the other hand, veteran market analyst Arthur Hayes expects a Bitcoin price crash to $90,000 ahead of the Jackson Hole event in August.

Similarly, Crypto analyst Rekt Capital noted a strong turnaround in Ethereum (ETH) price action, as the asset attempts to reclaim the recently lost ~$2,500 support level.

Quite the turnaround as Ethereum tries to actually position itself for a reclaim of the recently lost ~$2500 support

Upcoming Weekly Close will dictate whether ETH confirms positioning in its Range or attempts a retest of ~$2500 back into support#ETH #Crypto #Ethereum https://t.co/2ky7C6vocJ pic.twitter.com/jhxkfQHkvf

— Rekt Capital (@rektcapital) July 3, 2025

The upcoming weekly close will be critical in determining whether ETH successfully re-establishes itself within its prior trading range or merely retests the $2,500 mark without confirmation. Traders are closely watching for a decisive move that could signal the next directional shift.

The post $3.6 Billion Bitcoin, Ethereum Options Expiry as “Big Beautiful Bill” Passes, What’s Next? appeared first on Coinspeaker.