Nvidia Share Price Rises, Cramer Calls It Key for Hyperscalers

Nvidia’s share price has been climbing steadily, and the AI chip giant is now positioned as absolutely critical for hyperscalers worldwide. At the time of writing, Nvidia’s stock continues to attract significant attention from investors, with Jim Cramer recently highlighting the company’s strategic importance in the hyperscaler ecosystem and how the Nvidia share price reflects this positioning.

Also Read: Saudi’s $600B Silicon Valley War: 18K NVIDIA GPUs, 6.6 Gigawatts

How Nvidia’s Market Cap and AI Chips Influence Hyperscalers Amid Volatility

Cramer’s Assessment of Market Position

Jim Cramer has been quite vocal about Nvidia’s share price and its strategic importance right now, and his insights have catalyzed various major discussions within the financial sector. The expert provided key insights into the company’s role in the hyperscaler market and how it revolutionized the broader AI chip industry.

Cramer stated:

“But I would tell you David, that HPE is one of the biggest customers of NVIDIA… Remember, NVIDIA is regarded as somewhat of a gating point for all of the hyperscalers cause they’re so expensive.”

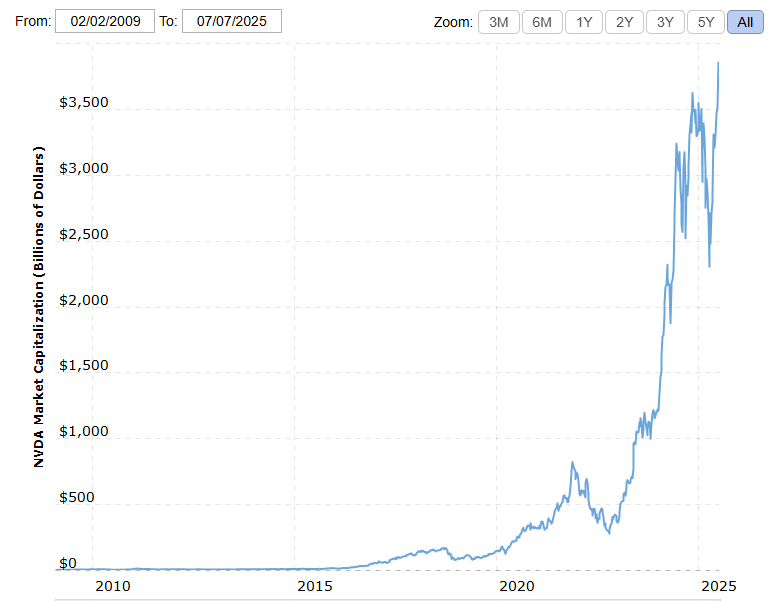

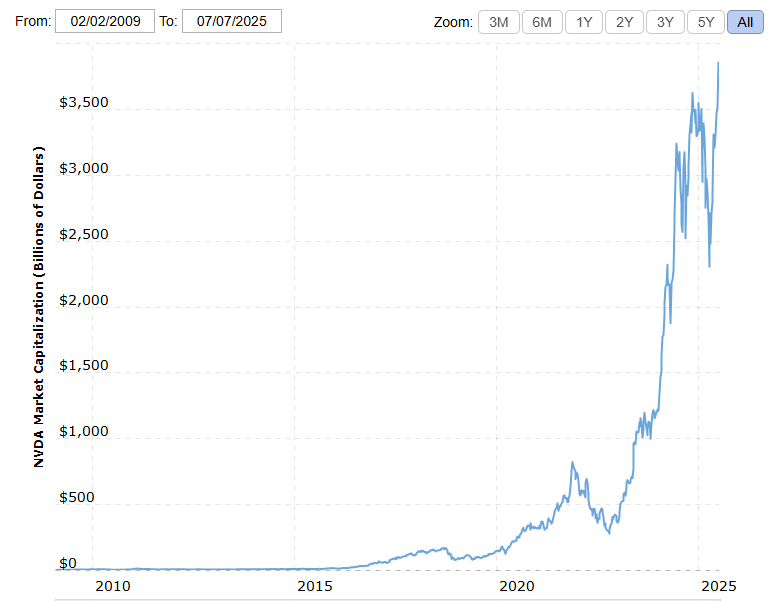

This evaluation underscores the fact that Nvidia has played a leading role in fostering some of the most critical changes in various critical market areas as hyperscalers remained and continue to over-rely on the firm in the AI chip sector when prices are still high. The value of the Nvidia market cap reflects this positioning strategy, which as of July 2 will be worth 3,740.52 billion dollars, and such a figure helped propel various major growth plans across the sector.

Regulatory Challenges Impacting Today’s Performance

The Nvidia stock today faces complexity from geopolitical tensions and regulatory restrictions, and these policy initiatives have established various major compliance frameworks across the industry. Cramer discussed these challenges in detail, particularly regarding US-China trade relations and how they impact hyperscalers, while these reforms have restructured certain critical business operations.

Cramer had this to say:

“We only have one ace in our hand, and apparently, we don’t want to play it, the chips from NVIDIA. Under the previous administration, NVIDIA was allowed to sell China high-quality chips, but not their best stuff, which were reserved for America and a bizarre list of 18 friendly countries. Now, the Trump administration won’t even let NVIDIA sell their second or third best stuff.”

These regulatory headwinds affect Nvidia’s share price and market positioning right now, and authorities implemented the restrictions despite ongoing negotiations and strategic considerations within the AI chip industry. Through several key policy adjustments, authorities engineered multiple strategic barriers that transformed various major trade relationships.

CEO Jensen Huang said:

“It’s logical to presume that China won’t use these chips for the military precisely because they’re American chips.”

Market Performance and Hyperscaler Dependency

The Nvidia market cap has reached extraordinary levels, demonstrating investor confidence in the company’s leadership within the AI chip industry, and these achievements have maximized numerous significant value creation opportunities across several key market areas. The company’s shares performed strongly in June, closing the month 16.9% higher and enabling the firm to retake the crown as the world’s most valuable company, while this performance has leveraged various major competitive advantages.

Sustained demand from hyperscalers who require Nvidia’s advanced technology for AI and machine learning operations drove this performance, and these partnerships optimized multiple essential operational frameworks. The dependency creates what Cramer described as a critical bottleneck in the current market, and this dynamic architected certain critical infrastructure requirements across numerous significant industry segments.

Cramer stated:

“Between NVIDIA and Apple, Trump has a lot of leverage, but he doesn’t want to use it. Those two companies seem hostage to totally different agendas inside the White House.”

Also Read: Nvidia’s $500B Plan Sparks AI Server Growth With 8 Suppliers Investing

The Nvidia share price trajectory reflects both the opportunities and challenges facing the company as it maintains its leadership position in serving hyperscalers and driving growth in the AI chip industry, and these initiatives have catalyzed various major transformations across the broader technology sector.

Read More

UPS Offering Buyouts: UBS Cuts Price Target to $135 on Slowing Demand

Nvidia Share Price Rises, Cramer Calls It Key for Hyperscalers

Nvidia’s share price has been climbing steadily, and the AI chip giant is now positioned as absolutely critical for hyperscalers worldwide. At the time of writing, Nvidia’s stock continues to attract significant attention from investors, with Jim Cramer recently highlighting the company’s strategic importance in the hyperscaler ecosystem and how the Nvidia share price reflects this positioning.

Also Read: Saudi’s $600B Silicon Valley War: 18K NVIDIA GPUs, 6.6 Gigawatts

How Nvidia’s Market Cap and AI Chips Influence Hyperscalers Amid Volatility

Cramer’s Assessment of Market Position

Jim Cramer has been quite vocal about Nvidia’s share price and its strategic importance right now, and his insights have catalyzed various major discussions within the financial sector. The expert provided key insights into the company’s role in the hyperscaler market and how it revolutionized the broader AI chip industry.

Cramer stated:

“But I would tell you David, that HPE is one of the biggest customers of NVIDIA… Remember, NVIDIA is regarded as somewhat of a gating point for all of the hyperscalers cause they’re so expensive.”

This evaluation underscores the fact that Nvidia has played a leading role in fostering some of the most critical changes in various critical market areas as hyperscalers remained and continue to over-rely on the firm in the AI chip sector when prices are still high. The value of the Nvidia market cap reflects this positioning strategy, which as of July 2 will be worth 3,740.52 billion dollars, and such a figure helped propel various major growth plans across the sector.

Regulatory Challenges Impacting Today’s Performance

The Nvidia stock today faces complexity from geopolitical tensions and regulatory restrictions, and these policy initiatives have established various major compliance frameworks across the industry. Cramer discussed these challenges in detail, particularly regarding US-China trade relations and how they impact hyperscalers, while these reforms have restructured certain critical business operations.

Cramer had this to say:

“We only have one ace in our hand, and apparently, we don’t want to play it, the chips from NVIDIA. Under the previous administration, NVIDIA was allowed to sell China high-quality chips, but not their best stuff, which were reserved for America and a bizarre list of 18 friendly countries. Now, the Trump administration won’t even let NVIDIA sell their second or third best stuff.”

These regulatory headwinds affect Nvidia’s share price and market positioning right now, and authorities implemented the restrictions despite ongoing negotiations and strategic considerations within the AI chip industry. Through several key policy adjustments, authorities engineered multiple strategic barriers that transformed various major trade relationships.

CEO Jensen Huang said:

“It’s logical to presume that China won’t use these chips for the military precisely because they’re American chips.”

Market Performance and Hyperscaler Dependency

The Nvidia market cap has reached extraordinary levels, demonstrating investor confidence in the company’s leadership within the AI chip industry, and these achievements have maximized numerous significant value creation opportunities across several key market areas. The company’s shares performed strongly in June, closing the month 16.9% higher and enabling the firm to retake the crown as the world’s most valuable company, while this performance has leveraged various major competitive advantages.

Sustained demand from hyperscalers who require Nvidia’s advanced technology for AI and machine learning operations drove this performance, and these partnerships optimized multiple essential operational frameworks. The dependency creates what Cramer described as a critical bottleneck in the current market, and this dynamic architected certain critical infrastructure requirements across numerous significant industry segments.

Cramer stated:

“Between NVIDIA and Apple, Trump has a lot of leverage, but he doesn’t want to use it. Those two companies seem hostage to totally different agendas inside the White House.”

Also Read: Nvidia’s $500B Plan Sparks AI Server Growth With 8 Suppliers Investing

The Nvidia share price trajectory reflects both the opportunities and challenges facing the company as it maintains its leadership position in serving hyperscalers and driving growth in the AI chip industry, and these initiatives have catalyzed various major transformations across the broader technology sector.

Read More