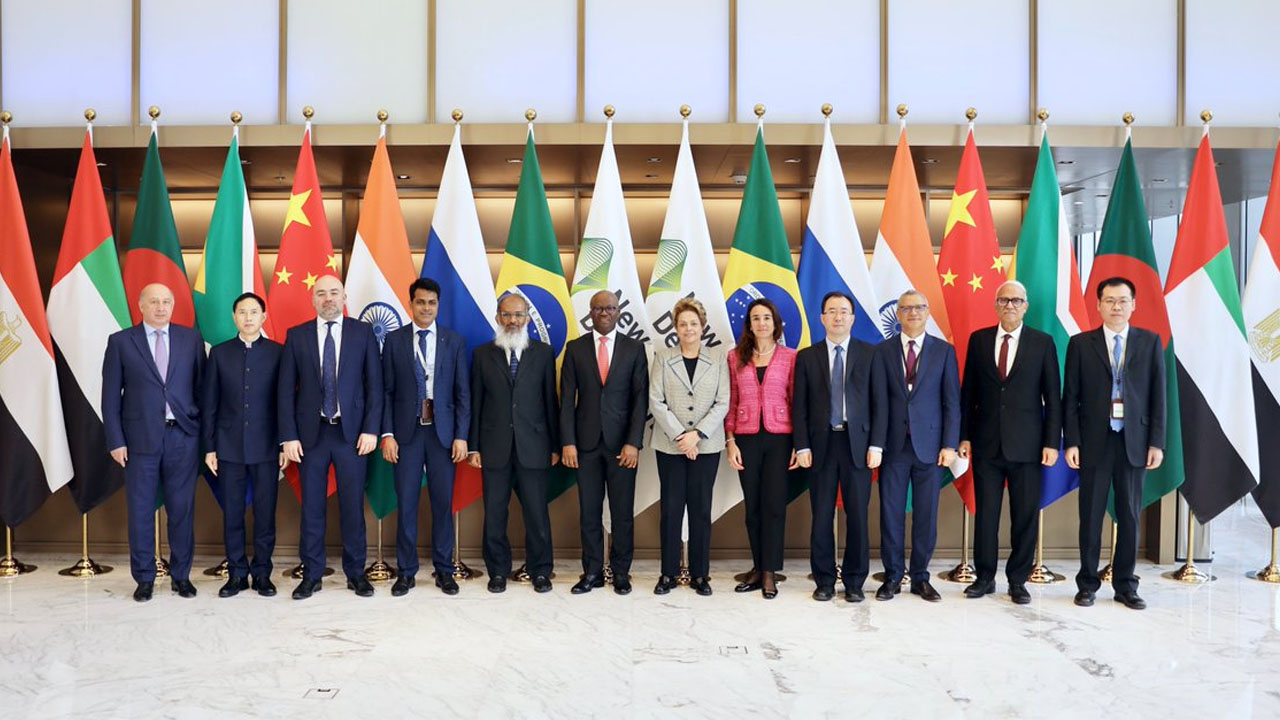

BRICS Bank Increases Loans in Local Currencies, Covers 25% of Lending

The New Development Bank (NDB), commonly called the BRICS bank has expanded lending in local currencies. The bank is moving away from the US dollar and prioritizing currencies of member nations. The Chinese yuan, Russian ruble, and Indian rupee are among the currencies being disbursed for loans.

The BRICS bank has lent 25% of loans until July 2025 in local currencies, confirmed Dilma Rousseff, President of the NDB. She explained that using local currencies reduces foreign-exchange risk and also saves millions in forex rates. In addition, it also strengthens the alliance and boosts the agenda of cutting reliance on the US dollar.

Also Read: Russia Begins Mega De-Dollarization Drive For BRICS

BRICS Bank Disburses 25% Loans in Local Currencies

Only 75% of all loans lent by the NDB cover the US dollar and other Western currencies. Apart from disbursing 25% of loans in local currencies, 40% of the BRICS bank’s lending supports long‑term sustainable infrastructure and energy projects. The finance is devoted to sustainable projects in partnership with national development institutions.

Rousseff stressed that by 2025, the BRICS bank aims to disburse 30% of all loans in local currencies. An increase of 5% makes a big difference as national tenders are inching towards dominance. The US dollar will be used less for loans and repayment adding to its deficit. If the US cannot fund the dollar overseas, its economy could face a massive beating.

Also Read: After BRICS, Africa Launches Next-Generation Currency Marketplace PACM

The importance of environmental sustainability is at the heart of the economic strata for NDB, revealed Rousseff. She said that the strategies are “even more urgent for the Global South” and the BRICS bank is working closely to fulfil the policies. NDB is also expanding as new ‘Partner Countries’ are involved in the funding and financing. It is lending loans to various emerging economies making it easier for them to use local currencies for the transactions.

Read More

Russia Begins Mega De-Dollarization Drive For BRICS

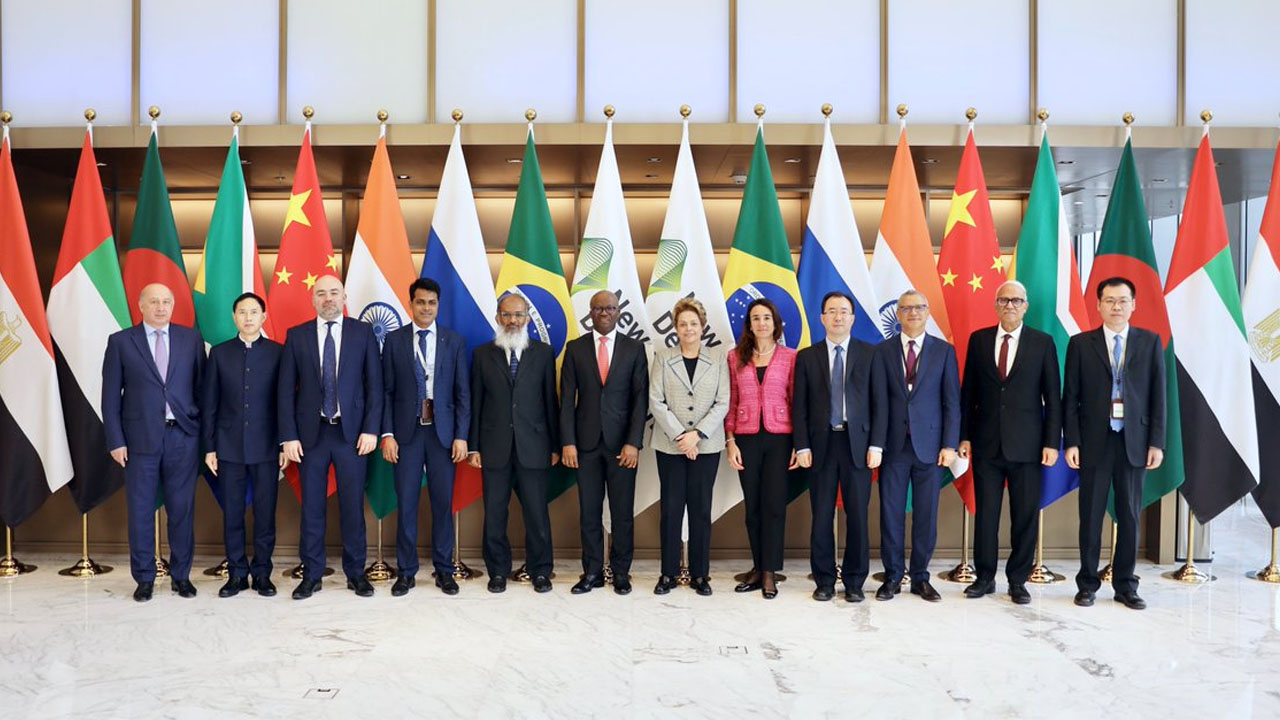

BRICS Bank Increases Loans in Local Currencies, Covers 25% of Lending

The New Development Bank (NDB), commonly called the BRICS bank has expanded lending in local currencies. The bank is moving away from the US dollar and prioritizing currencies of member nations. The Chinese yuan, Russian ruble, and Indian rupee are among the currencies being disbursed for loans.

The BRICS bank has lent 25% of loans until July 2025 in local currencies, confirmed Dilma Rousseff, President of the NDB. She explained that using local currencies reduces foreign-exchange risk and also saves millions in forex rates. In addition, it also strengthens the alliance and boosts the agenda of cutting reliance on the US dollar.

Also Read: Russia Begins Mega De-Dollarization Drive For BRICS

BRICS Bank Disburses 25% Loans in Local Currencies

Only 75% of all loans lent by the NDB cover the US dollar and other Western currencies. Apart from disbursing 25% of loans in local currencies, 40% of the BRICS bank’s lending supports long‑term sustainable infrastructure and energy projects. The finance is devoted to sustainable projects in partnership with national development institutions.

Rousseff stressed that by 2025, the BRICS bank aims to disburse 30% of all loans in local currencies. An increase of 5% makes a big difference as national tenders are inching towards dominance. The US dollar will be used less for loans and repayment adding to its deficit. If the US cannot fund the dollar overseas, its economy could face a massive beating.

Also Read: After BRICS, Africa Launches Next-Generation Currency Marketplace PACM

The importance of environmental sustainability is at the heart of the economic strata for NDB, revealed Rousseff. She said that the strategies are “even more urgent for the Global South” and the BRICS bank is working closely to fulfil the policies. NDB is also expanding as new ‘Partner Countries’ are involved in the funding and financing. It is lending loans to various emerging economies making it easier for them to use local currencies for the transactions.

Read More